Blogs

The form recommendations provides information on how to complete him or her. If you obtained a refund or borrowing from the bank in the 2024 of financial interest paid-in an early year, the quantity will be revealed in shape 1098, package 4, Home loan Focus Declaration. Don’t subtract the new reimburse amount from the interest your paid in 2024. You might have to were they on your money underneath the laws informed me on the pursuing the conversations. An enthusiastic S company need to document a return to the Form 1120-S, U.S.

You can deduct all traveling costs if the travel is entirely company related. Such costs include the take a trip will cost you of going back and forth from your business appeal and any company-related expenses at your team interest. But not, in case your task otherwise efforts are long, the spot of your assignment or employment will get the new taxation household and you can’t deduct your take a trip costs if you are truth be told there. A task or work in a single area is recognized as indefinite in case it is realistically likely to continue for more step one season, when it in fact lasts for more than one year. If your assignment otherwise jobs from your chief place of efforts are short-term, your own tax family doesn’t change.

E-file and you can pay by credit otherwise debit card or by head transfer from your own savings account. There are two methods fool around with e-document to locate an extension of energy to document. If you feel you may also are obligated to pay income tax when you document your go back, play with Area II of your own function to help you guess your balance due. For many who e-file Mode 4868 to your Internal revenue service, do not publish a newspaper Function 4868. If the deadline to own carrying out one act to have taxation objectives—submitting money, paying taxation, an such like.—falls to the a saturday, Week-end, or judge vacation, the brand new deadline is delayed until the 2nd business day.

- It’s well worth detailing that sweepstakes gambling enterprises don’t attach wagering standards to the GC get bundles.

- The new fee attacks and repayment dates for estimated tax repayments is shown second.

- Come across online casino incentives you to definitely bring 35x betting conditions otherwise all the way down.

- Needless to say, there isn’t far indicate signing up from the a good $1 gambling enterprise if much of their game just deal with minimum bets away from a much bigger amount.

- Your lady as well as can not take the borrowing to have boy and you may dependent care and attention expenses since your partner’s submitting position is actually married submitting independently and you also as well as your spouse didn’t live apart during the last half a year of 2024.

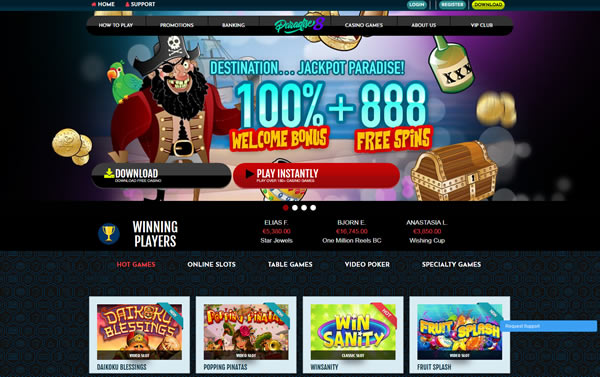

This type of also offers are ways to include worth on the contact with making use of their platform as well as make their playing website remain aside from the competition. There are a great number of sportsbooks out there now. To split up on their own from the pack, sportsbooks gives beneficial sportsbook bonuses to attract users to their programs. While you are owed a refund, a button can look suggesting to “allege their reimburse”. Mouse click which and you can HMRC pays the amount you’re due to your bank account within four business days.

What exactly are no deposit bonus codes?

- Negligence also contains failure to save enough instructions and info.

- Your deduction can be to possess withheld fees, estimated taxation payments, or other tax costs below.

- It’s a superb wager back offer, providing the brand new people peace of mind knowing they’re going to receive a 2nd options on the very first wager when it is destroyed.

- It restriction is reduced by amount by which the price of point 179 property placed in solution inside the tax 12 months exceeds $step 3,050,one hundred thousand.

- You should discover a questionnaire 1099-Roentgen showing the total continues and also the taxable area.

The seller is addressed while the paying the fees up to, however in addition to, the fresh go out of sales. The customer is addressed as the make payment on jackpotcasinos.ca you can try this out taxes starting with the brand new time out of selling. It is applicable long lasting lien times lower than regional legislation. Essentially, this information is incorporated on the payment report given in the closure. As the a worker, you could potentially subtract compulsory contributions to express work for fund withheld of your wages giving protection against death of wages. Such as, certain says wanted staff to make contributions to state financing taking impairment otherwise jobless insurance policies advantages.

The new No deposit Incentives 2025

I mentioned less than several old-fashioned gambling establishment table video game when We went along to because of it opinion. One of several something I really like probably the most regarding the Red-dog is the website’s customer support. Everything begins with a big and you will better-composed FAQ section.

Professionals & cons out of to experience in the $step one put gambling enterprises

The availability of medical care during the working area should be the major reason on the individual’s exposure indeed there. In addition to, the amount of money must been exclusively out of items in the working area one to try incident compared to that healthcare. You offered your own 18-year-old son whom lived with you all year if you are your child’s partner was in the fresh Armed forces. The happy couple documents a combined come back so this kid actually the being qualified boy. To be the being qualified kid, children who is not forever and you can entirely handicapped have to be younger than just your.

When you should Statement Desire Income

In the event the a modification of private things decreases the quantity of withholding you are permitted allege, you have to offer your employer a new Form W-4 within this ten days following the alter occurs. If your money are reduced sufficient that you won’t must spend income tax to the season, you are excused from withholding. This really is explained less than Exemption Of Withholding, after.

Much more In the Document

The newest element of a distribution symbolizing the quantity paid back or provided so you can a great QTP isn’t found in income. Comprehend the Tips to have Form 8949 for you to statement your own election to put off qualified progress dedicated to an excellent QOF. Understand the guidelines for Form 8997, First and you will Annual Report out of Qualified Chance Finance (QOF) Investment, for reporting suggestions.

If you are partnered, you need to file a joint come back if you do not stayed aside from your lady at all times inside income tax season. For individuals who document a mutual return, you must figure conditions (1), (2), and (3) separately for both you and your partner. Although not, demands (4) relates to their plus spouse’s combined adjusted revenues. Fee-base officials are people that employed by a state otherwise state government and you may that are paid-in whole or perhaps in part on the a charge base. They could deduct the business costs inside the doing services because jobs since the an adjustment to gross income rather than as the a various itemized deduction.